Can your mood move the market?

London Business School Finance professor Alex Edmans explains his research showing that collective moods matter, both to your health and the stock market

It’s the end of another academic year, and as a professor, I usually feel only happiness and excitement in the air as graduates prepare to walk the stage and accept their diplomas with lots of pomp and circumstance. But this year the mood is different. College campuses around the country (mine included) have seen an unusual degree of discord. The noticeable sentiment shift got me thinking about the interview I feature this month, which dives into some of the research on how much the collective mood of a region, country or even the globe can matter in ways that I, at least, find fascinating and a bit counterintuitive — affecting our decisions, our health, and even the stock market. I hope you’ll find it interesting.

This Month’s Recommended Listens and Reads

Culture Matters: In this recent episode of Choiceology, we cover the incredible research of Stanford psychologist Michele Gelfand on how tight versus loose cultures affect our creativity, ability to respond to threat and generally shape our choices.

What Inspires Great Behavioral Science Research? This Q&A from Behavioral Scientist with the brilliant Princeton psychologist Betsy Levy Paluck is a wonderful opportunity to nerd out and learn where great research ideas come from.

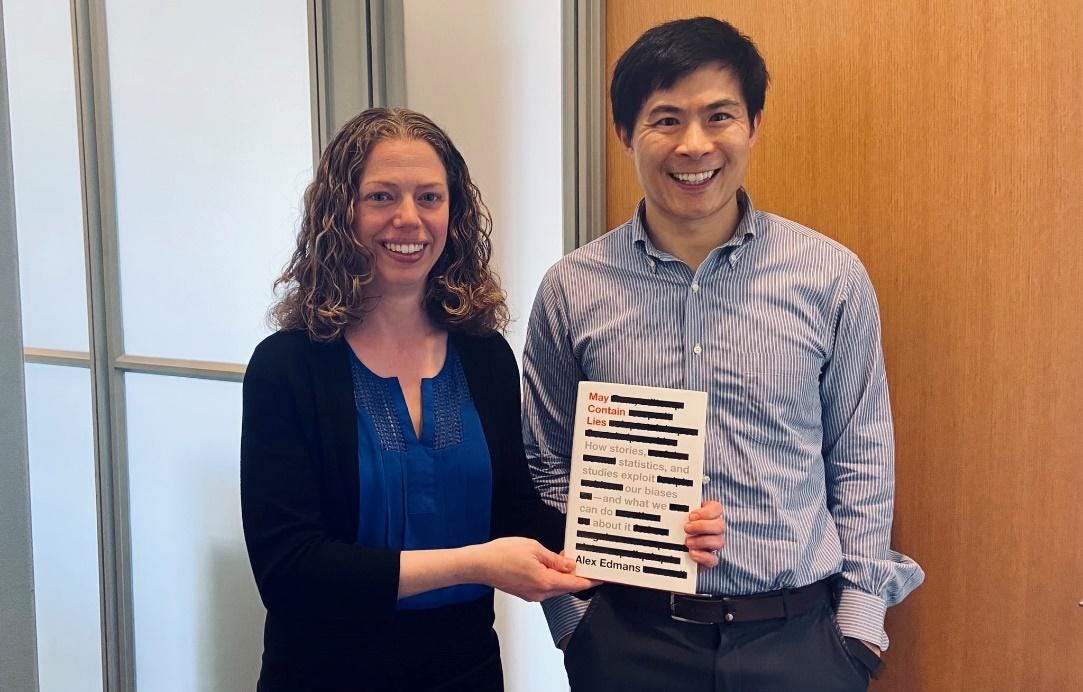

May Contain Lies: How Stories, Statistics, and Studies Exploit Our Biases―And What We Can Do about It: A terrific read and my favorite science book of the year so far, May Contain Lies will soon be on the syllabus of my Wharton MBA class and is sure to improve the quality of your thinking (P.S. It was penned by the outstanding scientist featured in this newsletter’s Q&A, and below you can see us posing together for a photo).

Q&A: Your Mood and the Stock Market

In this Q&A from Choiceology, London Business School Finance professor Alex Edmans discusses his research proving that your mood really matters to the stock market.

Me: Alex, I'm thrilled to talk to you about sentiment or what most of us call mood, because I know very little about it. Can you describe some of the fundamentals about how feeling good versus bad changes people's outcomes?

Alex: We looked at outcomes like health. For example, when England lost to Argentina in the 1988 football (or, as we Americans know it, soccer) World Cup, heart attacks shot up over the next few days. When the Montreal Canadians were eliminated from the Stanley Cup, people died by suicide more over the next few days. And in the U.S. when a team gets knocked out of the NFL, sometimes homicide goes up.

Me: Let’s talk about your work on the impact of people’s general mood or sentiment on the stock market. What did you find and how did you study this?

Alex: What I looked at with my coworkers, Diego Garcia and Øyvind Norli, was the effect of international soccer elimination on the stock market.

We wanted to look at many, many countries throughout the globe. And we found a really strong effect. When you get knocked out of the World Cup, the market falls by half a percent on the next day. Applied to the England stock market, that’s $15 billion off the market on a single day, just because England can't take penalty kicks.

Then we went a little bit further and thought the effect should be stronger in countries where soccer is more important. It was stronger in England, France, Germany, Spain, Italy, Argentina, and Brazil. And there was no effect in the U.S., but when we looked at other sports—rugby, cricket, basketball, and ice hockey—we found that those also had significant negative effects. There was generally a negative mood effect on a nation when they lose a major sporting event.

Me: And what about when they win?

Alex: Unfortunately, when they win there isn’t a positive effect. Sports are only having negative outcomes—a decline upon a loss, but no rise upon a win.

Me: That's so disappointing. Why do you think we only see this downside?

Alex: So, one of the behavioral reasons is overconfidence, where, if you've got supporters who always go into a game thinking that they're going to win, then they’re not too surprised when they do. But they’re bitterly disappointed when they lose. And then there’s a more technical reason that depends on the competition format. Because these are knockout competitions, if you lose, you're instantly eliminated. If you win, you still haven't won the championship.

Me: That’s so interesting. I noticed you have a new paper on the relationship between the music people are listening to in a country and the stock market’s performance. Could you tell me about that project?

Alex: So, most papers in this area study shocks to sentiment. It could be soccer results. It could be clock changes. It could be weather. And then they assume that those things affect people's sentiment, and it feeds through to the stock market.

However, all those measures only capture one driver of sentiments. How are we feeling on a particular day? Yeah, maybe I'm upset that my soccer team lost, but maybe I'm happy because I got a promotion at work or maybe COVID restrictions are easing and so on. So rather than having an exogenous measure, that shock sentiment, what I want is an endogenous measure, which reflects how happy you are feeling over time.

Now that's difficult because many of the ways emotions manifest, you can't observe as an empiricist. So, let's say if I start swearing all the time, because I'm angry, hopefully that's not going to be captured by Alexa. Maybe in the future there will be clever ways of getting that data, but not now. You might think, well, why don't you look at consumption? But it’s really difficult to determine whether the things people buy are positive or negative. If I'm buying alcohol, it could be to celebrate or to commiserate. So, we chose to look at music. A lot of prior research in the psychology literature documents that you listen to music that reflects how you're feeling. That's why we play happy songs at parties and sad songs at funerals. And what’s particularly helpful is that Spotify has an algorithm to study the positivity of the music people listen to daily. One of the songs which was scoring really high was “Happy” by Pharrell Williams. And then you have some Adele songs and the sad Coldplay songs at the bottom.

Me: And then you looked at how the music people are listening to on Spotify in different geographies relates to stock market returns?

Alex: Absolutely. We got 500 billion streams of 58,000 songs across 40 countries. And we went beyond the soccer paper because we didn't just look at the stock market, we looked at two other outcomes: mutual funds and government bonds. We found that when people are in a better mood, they're buying more mutual funds and fewer government bonds because people are willing to take more risks when they’re feeling positive and they're investing more in stocks. But the money has to come from somewhere and government bonds are a safe asset, which you're going to be selling out of if you want to move into something risky.

Me: I'm curious if there's anything you do differently in your day to day, as a result of studying how mood can affect choices?

Alex: Well, as an individual, even though I am cognizant and knowledgeable about finance, I recognize that I might be driven by emotion. So, I try not to make decisions in anger. I’m the managing editor of an academic journal. It's a great honor, but also a great responsibility. And if I'm going to be reviewing papers, I know that if I've had a bad day at work, that might feed through into my decisions. So, sometimes I read a paper on one day and then come back to it a few days later, just to make sure I'm getting two different snapshots because I am fallible, I am prone to sentiment and emotions and a decision made at one point in time might be driven partly by my mood.

In general, I try to follow my childhood chess coach’s advice to “sit on my hands.” I started playing chess when I was five years old and played for the England junior team. But I would make rush moves. And so my chess coach said “sit on your hands” so I wouldn’t be able to make quick moves even if I think there's an obvious response. And I think that should be the same for important decisions.

Me: I talk about decision readiness to my students at Wharton. And I love this idea that you try to keep an eye on your emotions and come back to important choices multiple times, rather than letting the heat of the moment guide you. We should all sit on our hands more. I really appreciate you taking the time to talk with me, Alex. Thank you.

This interview has been edited for clarity and length.

To learn more about Alex’s work, listen to the episode of Choiceology where we dig into the topic or buy a copy of his fantastic new book, May Contain Lies.

That’s all for this month’s newsletter. See you in June!

Katy Milkman, PhD

Professor at Wharton, Host of Choiceology, an original podcast from Charles Schwab, and Bestselling Author of How to Change

P.S. Join my community of ~100,000 followers on social media, where I shares ideas, research, and more: LinkedIn / Twitter / Instagram